Unlock Passive Income Through GInvest's Dividends

Introduction to GInvest’s Dividend-Paying Fund

As stated by GCash, GInvest’s ALFM Global Multi-Asset Income Fund’s main goal is to provide consistent flowing dividends to the investors and growth in capital appreciation. But what is a dividend?

To keep it simple, a dividend is an earning being received by shareholders from corporations to which investors put their money in. Dividend income may also vary depending on the company performance, as well as how much share you own.

GInvest’s ALFM Global Multi-Asset Income Fund is the feeder mutual fund (collective investment funds contributed by smaller investors to a corporation also known as the master fund) in the Philippines, and 90% of its assets are to be invested into a single collective scheme. When it comes to dividend income, it will be received by GInvestors on a monthly basis and will go directly to their GCash account.

Buying GInvest’s Dividend-Paying Fund in just a Few Taps

- Upon opening the GCash app, go to “GInvest”.

- From the options, tap “ALFM Global Multi-Asset Income Fund”. You might want to check its details as well.

- Click “Buy” once you’ve decided.

Voila! You just bought your first investment through your mobile wallet.

Here’s a few reminders:

- Php 1,000.00 is the minimum amount to invest.

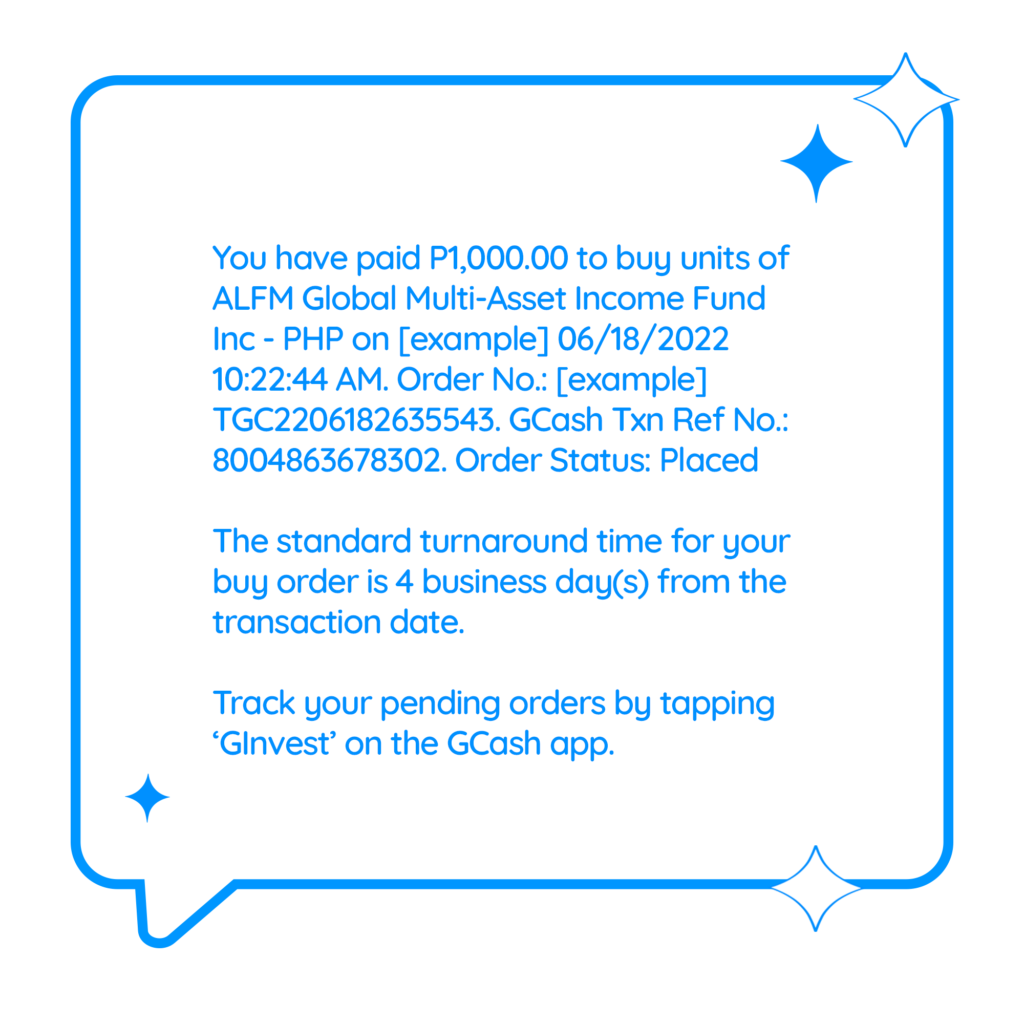

- Buy orders take four (4) days to process, but it may vary.

- The basis for the price date is the Net Asset Value Per Unit (NAVPU).

You will also receive a text message saying:

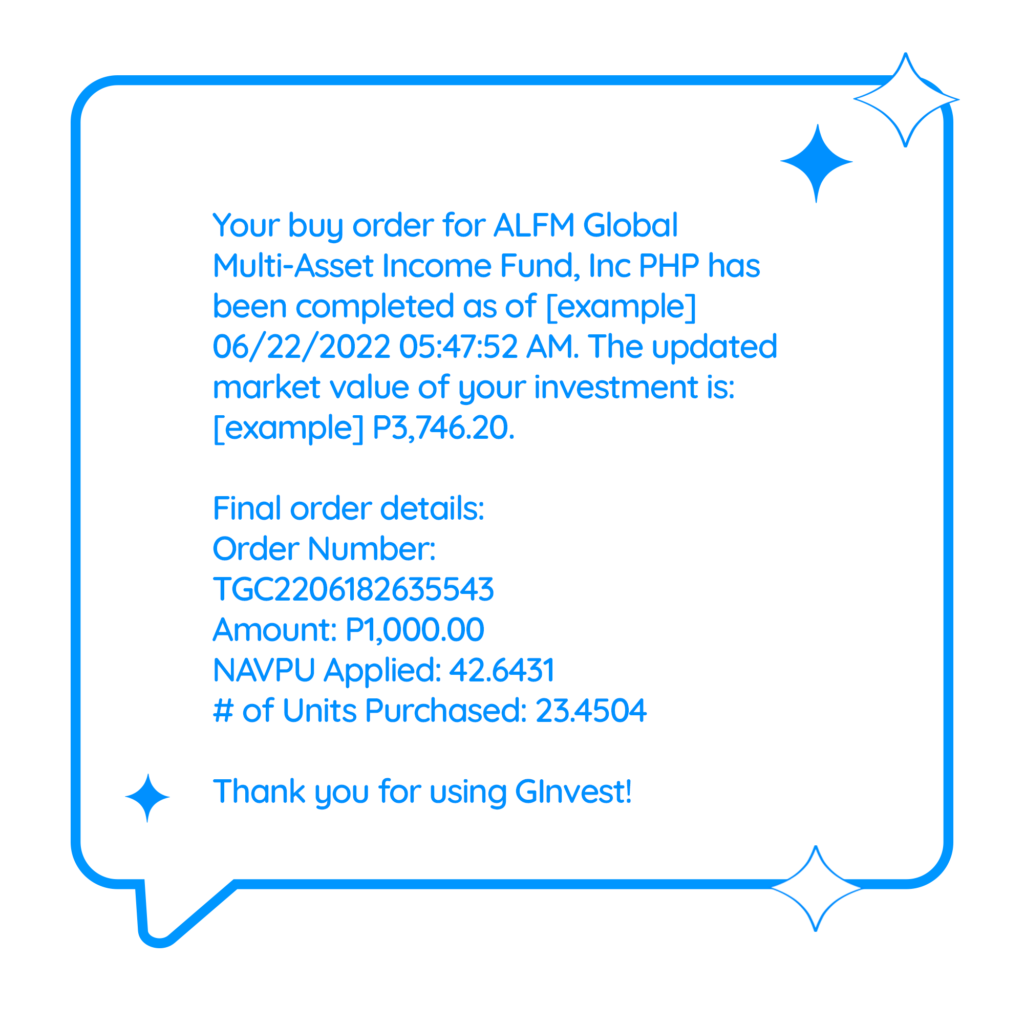

Once the order has been completed, you will receive an update on NAVPU applied, number of units purchased, and updated value of your portfolio.

Whereas, you can pull out your funds by tapping the “Sell” which would take eight (8) business days to process, with the price date that was based on the next business day after selling it. See the formula below to compute how much would be credited to your account:

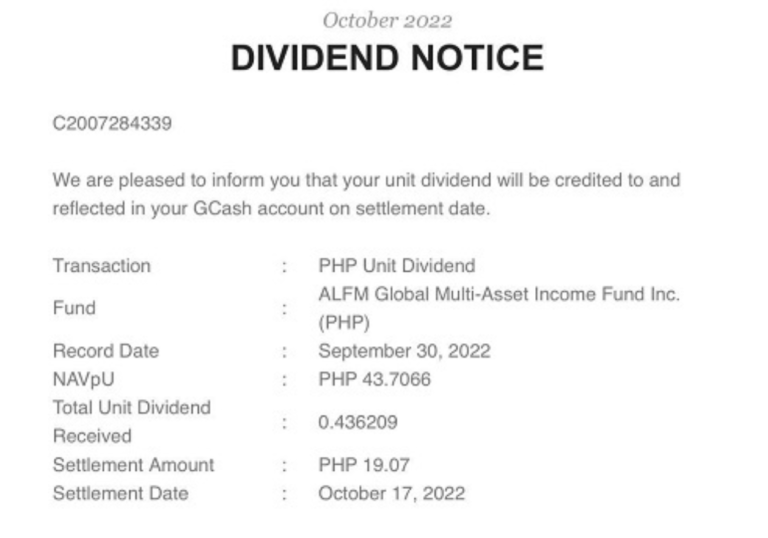

Number of fund units you have x unit dividend (indicated in the dividend notice) x NAVPU as of record date

Example:

1 (number of fund unit) x 0.436209 (Total Unit Dividend) x Php 43.7066 (NAVpU), which equates to Php 19.0652 or Php 19.07

Illustration 1. Sample Dividend Notice

When dividend has been credited, you will received a text message stating:

FINAL REMINDER

You have to remember that just like any other form of investment, it may come with risks. Factors such as geopolitical events, constant change in economic conditions, and the market could contribute to your fund’s value. Which is why you should never rely on your investment(s) when it comes to emergencies— investment funds and emergency funds must be separate entities. Before you allocate money for your future investments, make sure you have first set aside funds for your emergency fund. Doing so indicates that you can also afford the financial risks associated with investing.

RECOMMENDED ARTICLES TO READ

© 2024 Project Conquer. Designed & Developed by Jake Bonhart Villado.